FX Risk Management

Managed FX & Bespoke Active/Passive Hedging

Managed FX is a treasury service Bastion Currency Management (BCM) provides to help manage a client's foreign exchange operations. The objectives & functions of this service vary depending on client needs, but start with a treasury and risk consultation (available as a standalone service).

Initiating a Managed FX service means we do the heavy lifting by building you a framework that directs risk management decisions, efficient execution of risk management strategies, competitive pricing of FX rates & hedging structures through your existing counterparties (or sourcing and vetting new ones), independent fair valuation of financial instruments, professional deal execution in line with treasury FX policy, favourable price seeking activities, regular reporting and bank/broker fee negotiation.

Our FX survey, as well as a study by the IMF, found that most SMEs are being overcharged 26 times more than their more sophisticated peers, and most don't know the fees they are being charged on all manner of financial dealing. This raises the importance of undertaking an independent, transaction cost analysis to review facility terms and pricing agreements for fairness. Our experience has shown us that banks/brokers have no magic formula or logical reasoning for what they charge a client other than basing it on the strength of the relationship and the client's experience and knowledge of FX markets and instruments. The stronger the relationship and the less the knowledge, the more they charge! Let us take care of these pricing frustrations along with other trading related headaches.

There are many benefits to having professionals manage your FX and related treasury needs, with the significant and immediately realized ones being cost savings through spread reduction, and efficiency and productivity gains as your employees' time and skills are better utilized in their designated roles while you leverage BCM's specialized knowledge, experience and skills in the currency markets to manage this particular and demanding area.

We look after the pennies, so that your dollars look after themselves; which is the goal of any well designed, comprehensive FX policy with an accompanying, managed hedging program. We pay attention to every detail, no matter how small, to perform at the highest level you would expect of a professional. We work closely together with you, as no one knows your company's needs better than you, to complement and supplement your own areas of expertise as naturally would happen were we your employee, which we consider ourselves to be!

(Continued top right or below on mobile devices)

Learn MoreBespoke Passive Hedging & Active Hedging are services where companies retain us to manage their currency risk / exposures, separating their core business decisions and currency risk management, so they can focus on the former. We seek to reduce the currency-specific risks of your operations, which can be just as time consuming as your main business, and take a hands-on approach seeking to limit the downside currency exposure while also increasing the returns from a favorable currency move through our Enhanced and Hedging Plus services. Bespoke Passive Hedging is chiefly a risk mitigating strategy whereas Active Hedging may seek some allocation to currency risk premia.

Our Bespoke Passive Hedging program is a customized solution designed with every aspect and associated currency risk being assessed and addressed to mitigate risk. There are often opportunities to add value by minimizing costs and maximizing operational efficiencies with tactically improving hedging outcomes, which may be suitable to certain clients from time to time.

Conversely, our Active Hedging programs (Enhanced & Hedging Plus), use two different methods that are not dependent on currency movement "calls". These strategies operate by varying the currency hedge ratio, usually within, and constrained, to a predefined range (0% to 100%).

The Enhanced Hedging strategy uses Dynamic Currency Hedging (DCH) to add value by closing loss-making hedges in a timely fashion, so negative cash flows are reduced yet maintaining profitable hedges. DCH seeks to exploit the trending characteristics of the currency markets.

The Hedging Plus strategy targets a greater exposure to profitable hedges through incorporating signals based off well understood price behaviours and factors prevailing in the currency markets: macroeconomic/country specific conditions (value), interest rates (carry), momentum (trend) and volatility (realized vs implied).

Hedging is often overlooked by SMEs due to the lack of resources, knowledge, and the complexity and perceived costs of hedging while for those currently hedging, so too is one (likely many) very important benefit of an Active vs Passive hedging strategy. Passive hedging can lead to very substantial negative cash flows from margin calls and large realized losses if the exchange rate move is extreme, such as what happened during the financial crisis when the US dollar drastically appreciated. Active hedging, by its very nature, reduces the potential of being caught on the wrong side of such a move and the subsequent large, negative cash flows although closing losing hedges will incur a trading cost.

Hedging FX exposures is important, but too many "experts" focus on exposures without taking into account cash flows, which are just as, if not more, important. Under our Active Hedging programs, if you are an exporter, the hedge ratio would be increased (lowered for an importer) when we anticipate base currency strength and lowered (increased for an importer) in anticipation of the base currency depreciating. As complicated and resource intensive as this may be, the best part is that we do ALL the work, saving you a substantial amount of time and effort, which can be reallocated to more profitable and important tasks.

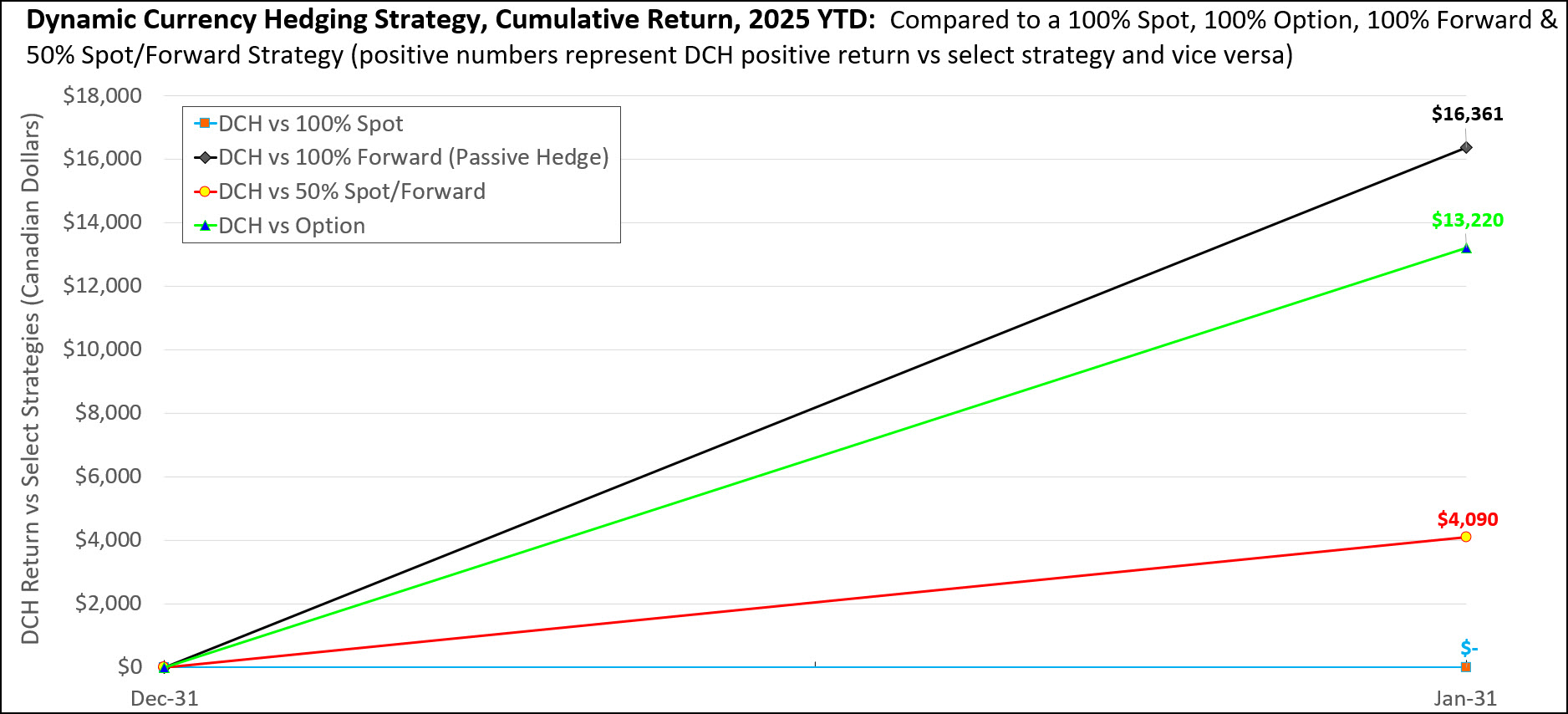

2025 Dynamic Currency Hedging Benefit vs 100% Spot, 100% Options, 100% Forward & 50% Spot/Forward

Previous years' results from Dynamic Currency Hedging:

- 2024's DCH Results

- 2023's DCH Results

- 2022's DCH Results

- 2021's DCH Results

- 2020's DCH Results

- 2019's DCH Results

- 2018's DCH Results

Source: Bastion Currency Management calculations.

Important Information: Period under review is January 2025 to December 2025. The results are from a model portfolio trading US$1,000,000 per month (total US$12 mln/year). Figures are quoted gross of fees. The returns presented year-to-date reflect the hypothetical performance a Canadian exporter would have obtained had it utilized the applicable, Dynamic Currency Hedging strategy to hedge its U.S. dollar revenues. Hedging can be viewed as a binary event in that if an exporter should hedge, an importer should not hedge as it is always better to be either 100% hedged or 0% hedged. The results shown are for a Dynamically Currency Hedged (DCH) model portfolio that uses a version of option replication to shift the hedge ratio between 0% to 100%. Essentially, this strategy seeks to harvest the option premiums one would have paid for options spanning 2024. For example, in 2023 the option premium cost for the below plain vanilla strategy was C$340,837 (or 2.08% of the total 12 mln USD hedged). The DCH strategy under option replication captured C$275,233 (80.8%) of the option premium one would have paid buying the put options, which for comparison purposes was 1.68% of the total 12 mln USD hedged. Note that the 1.68% was a positive return to the corporation whereas the 2.08% was a cost paid by the corporation to its bank/broker. The DCH strategy is then compared against the four most common methods of currency management for corporations. The first portfolio has its foreign exchange needs satisfied by trading 100% spot USD/CAD at month end. The second strategy hedges 100% via FX Forwards at the current month end's spot closing rate for the following month's needs. The third sells 50% of needs at month end spot rate and 50% via forwards at the current month end's spot closing rate for the following month's needs. The fourth strategy is buying a strip of 12 plain vanilla put options on January 1, 2025 for settlement at each month-end in 2025. The premium (cost to buy the option) for the underlying option is paid at the time of buying the option. The premium (cost) is added/subtracted to each month-end's exchange rate to derive the net-exchange rate traded. Please note that these results, although based upon actual market data for USD/CAD, are hypothetical as each and every clients' needs and circumstances are unique and the program can be constructed in any manner of ways to achieve diverse objectives. These results are for illustrative purposes only; to highlight the benefits that may accrue from an active approach to a firm's currency management against the typically passive currency management in place at most corporations. Past performance does not guarantee future results!

We Make Managing Your Currency Risk to Protect Your Profits Hassle, and Worry Free

If you want us to help you unlock your Treasury's ROI to stop missing out on all the opportunities to improve margins and find cash flow, then check availability for scheduling your free Treasury Audit

Free Audit