Advisory & Smart Currency Quantum

Currency Concierge

Our Currency Concierge service is a leading edge business support system that enables you to remove the stress from currency matters and focus on the important things, like growing your business, because we're always here when you need us! Our time, attention, concern and considerable currency and risk management skills are always on call. Whether you choose to avail yourself of our typical bespoke services on an à la carte basis, choose to task us with unique currency research specific to your business, or need timely, independent advice or insight you're covered for every service by our standalone consulting and retainer agreement. Essentially, any currency-related task you find yourself in need of, no matter how arcane or mundane, we are there to support your business in any capacity you deem necessary as Bastion takes care of a spectrum of solutions via services that complement or supplement your in-house currency and derivatives operations. Ongoing or finite engagement, including contingency hedging services.

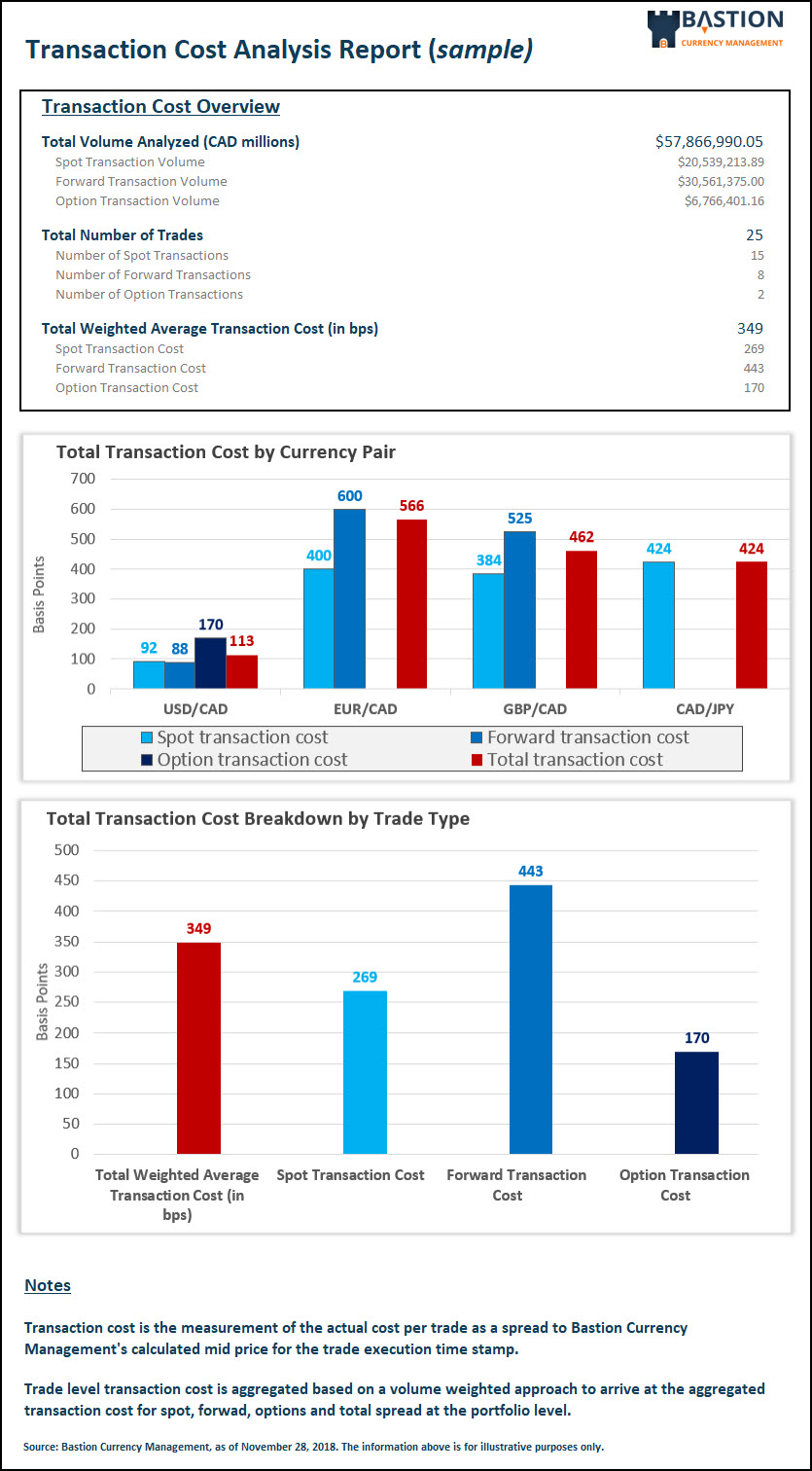

Transaction Cost Analysis

Trust, but verify. A TCA is the most effective way to assess the quality of your FX execution (i.e., the exchange rates you are trading on from your FX provider). Actually, it is a central tenet to safeguard transparency in an asymmetric relationship, where one party has more information than the other (your FX dealer has more info. than you). Additionally, a TCA is fundamental to your FX trade execution process for ongoing comparison of the quality of your trade prices against the wider market, to demonstrate 'Best Execution' (see FX Global Code), and as evidence of good governance showing your stakeholders that you are protecting your firm's value against excessive, and usually hidden, FX costs.

Sadly, far too many corporations are under the impression that their FX provider is dealing with them in perfect fairness and absolute honesty. Our own, internal data shows us that nearly 100% of corporate clients actually have little to no knowledge and transparency on what their FX dealer is charging them in markup. In fact, a 2019 study by the IMF & European Central Bank proves that if you aren't a large, multinational with the sophistication afforded by having a Treasury team, then FX Dealers consider you increasingly unsophisticated the smaller your company is, and they will overcharge you by up to 26 times more than what they charge a larger, more sophisticated company. Ouch!

Depending on whether you deal with a bank or a broker, the process for determining what you will be charged is different in some respects and similar in others. In contrast to a broker, a bank, when calculating the sales markup on an exchange rate, will consider its own FX positions and exposures, and then starts skewing the price for each client according to their total value to the bank, their credit rating (e.g., Dunn and Bradstreet), and market conditions. For both banks and brokers (the latter uses the following to near exclusively determine markup), the most important factor pertaining to how much they will [over]charge you (and if they can, they will) is your sophistication! If you lack the resources of a multinational corporation, and would consider your Treasury FX expertise as being less sophisticated than that of a multinational, then the simple fact is that you WILL be charged more—much more—and this is why a TCA is so important for corporate treasuries.

Our independent Transaction Cost Analysis will compare your executed trade price against the actual exchange rate, finding those hidden costs and spotlighting your FX provider's attitude toward your business based on their "adjusted" spreads (i.e., fair shake or pillage and plunder). Most corporate FX deals transacted with a bank/broker offer the minimum in transparency on executed rates and times. There is usually no timestamp as to when the actual deal was booked on the market, no reference to the market rate at time of execution, no split in the "all in" pricing to show markup and forward (swap) points if applicable. Even worse, they will do their best to push you into non-linear products like vanilla/exotic/structured options because these are infinitely more difficult for you to price, which means they can make larger profits on those transactions due to the information asymmetry (that word again). Our TCA can help place an accurate value on these deals, past and present, and the costs associated with them.

FX trading costs directly hit a company's bottom line. For example, exchanging $1,000,000 USD at a USD/CAD rate of 1.3000 when the true interbank rate was 1.3100 just cost your company $10,000 on one transaction! For an at arms-length transaction, which is pretty much the business model of every bank's corporate FX trade floor and is the only modus operandi of every FX broker, this would equate to a huge, unwarranted and undeserved fee! This directly and negatively impacts your operating margins through inflated COGS or and/or deflated revenues, but you will never receive a bill showing you the real cost. Without knowing how much your foreign exchange operations are actually costing you, it follows that it is impossible for an accurate and detailed evaluation of your FX provider(s) to be performed to hold them accountable.

Our analysis reveals your actual FX transaction costs in a way that is transparent and easy to understand.

- Protection in an over-the-counter (OTC), unregulated market

- Cost transparency for currency transactions: spot, forwards, options

- Measure to manage costs as you can't control what's not quantified

- Identification of saving potentials by benchmarking FX costs

- Assess the competitiveness of your deal prices by isolating cost impacts from deal size, deal type, currency and FX counterparty

- Validation of current FX Execution arrangements (i.e., holding your counterparty to account)

- A TCA helps satisfy fiduciary responsibilities a company has to its shareholders

- The richness of data provided by a TCA is paramount if you wish to negotiate better rates with current FX providers

Your benefits:

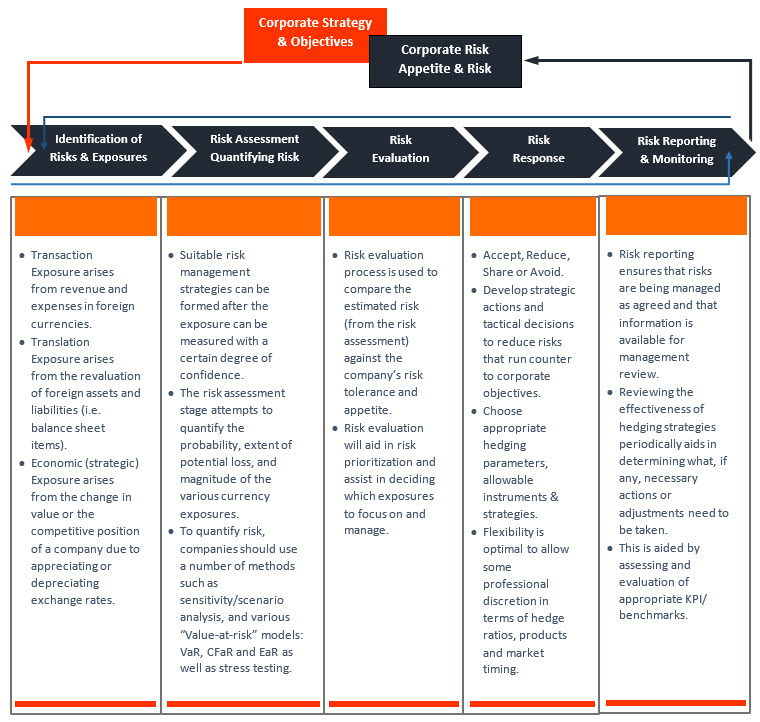

Foreign Exchange (FX) Risk Management Policy

An FX policy is a documented set of directives outlining organizational objectives, strategies and procedures with regard to managing currency risk. It can be broken down into five broad sections: 1) Identification of Risks & Exposures 2) Risk Assessment & Quantifying Risk 3) Risk Evaluation 4) Risk Response 5) Risk Reporting & Monitoring. It includes exposure types to be managed, and tactics to be implemented to alleviate this risk, including specific financial instruments to be utilized. Any business operating with an exposure to overseas markets will be exposed to foreign exchange rate risk, commonly known as transaction, translation and economic (TTE) risks, and need a formalized approach to manage these risk to avoid ambiguity and uncertainty when faced with making FX-related decisions. It is imperative to have a plan in order to deal with these complex risks consistently and efficiently, especially when FX markets take off!

Changes in FX rates directly influence the overall costs and profitability for an organization relative to overseas business dealings. Failure to implement an FX risk management plan can leave your company exposed and ill-prepared to manage the effects of unfavorable currency moves. Currency volatility can have a severely adverse effect on a company’s bottom line, but it doesn’t need to! Many companies either inconsistently manage their FX risk or tend to give priority to issues like following FX markets and the selection of FX hedging instruments. These matters are important, but they always come at the end of a risk management process that must begin with identifying and then measuring the foreign exchange exposures that you want to manage. Lack of quantifying exposures and risks leads to inconsistent results and often when losses are generated, a company's financial statements show only parts of the transaction and portfolio risk making it very difficult to pinpoint where the losses stem from. We cannot monitor, track and evaluate what we do not measure!

The most important impact of currency changes, which come from structural risk, finds its way into the income statement through movements in revenues and costs but not as an explicit line item. In fact, standard financial reports can even lead to the wrong conclusions about a company’s exposure to movements in currency rates by overemphasizing the accounting effect on earnings rather than the real effect on cash flows. This is why the first step of a comprehensive FX policy concentrates on identifying cash flows as the focus should be on these rather than earnings. Hence why we must measure first, so that we can then manage the risks intelligently and correctly.

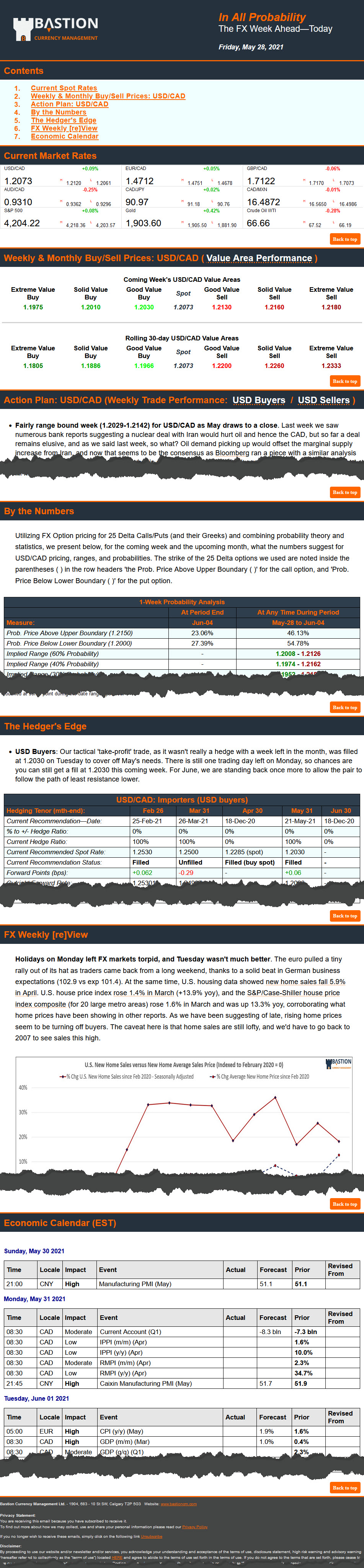

In All Probability

You asked, we delivered! At Bastion we're always looking to improve our products and processes based on feedback from our clients and one suggestion that consistently had been at the top of the heap from both existing and prospective clients was "useful, timely & actionable currency intelligence." Thus began our journey into developing our "In All Probability" weekly FX product. It took some time as we scoured through reams of industry reports from banks and brokers, many of which were provided by you, to get an idea of what was lacking, and with your guidance and feedback we released our inaugural "currency intelligence" product at the beginning of 2020.

Our major findings and your major gripes with existing industry products were basically the same. By far and away the main issue was almost every single report from both banks and brokers loved to talk in great detail about economic data, but never talked about how this information was actionable to you, the reader. And all the so called reports that focused on the upcoming week or month, suffered the same existential problem—they described upcoming events of interest, but never explained how these are relevant to currency markets, or what the potential impact is on the exchange rate. So, unless you have a burning desire to read staid economic reports because that's what all these bank/broker reports are, you're chasing your tail in hopes of finding actionable currency intelligence that will help your business.

Another major headache most of you had were the products you received came too often (e.g., daily, intra-day) overwhelming you with a constant stream of information, that generally wasn't applicable to your situation. The flip side of that was the products were not timely enough (e.g., monthly, quarterly), where anything actionable was stale by the time of receipt. This led us to the happy medium of choosing a weekly product that was frequent enough to keep you abreast of foreign exchange developments, but also delivered to you at the end of the week allowing you to catch up over the weekend and get a view on events in the coming week, but at a time when urgent business matters weren't a pressure. So far, we haven't had any requests to change the frequency, so thank you for steering us in the right direction!

For those relying on products from banks, you told us they are hard to read and understand. This makes sense because bank reports are geared toward a 'financial market savvy' audience (e.g., mutual funds, pensions funds, multi-national corporations, etc.) rather than targeting corporate needs, especially those of small medium enterprises. Having poured over so many of these products as we analyzed them to see what they were missing, it was quite clear that these products lacked readability for the corporate audience as they got bogged down in the minutiae and jargon of financial markets. There are also way, way too many bank reports on every piece of economic data and event, spread out all over the banks' websites making it a nightmare to quickly and easily stay on top of market trends that are relevant to you. On top of that, most of the reports play it very safe by talking just about the data, preferring to steer clear of saying anything useful such as how they see events unfolding and what that means for you when it comes to effects on the exchange rate. Summing up bank reports for corporate users in one word: useless.

On the other side of the coin are products from foreign exchange brokers, which nearly all of you derided as lacking any real substance, especially about foreign exchange related matters. When we parsed reports you sent us that covered most corporate FX brokers in Canada, we also found, just like you told us, that they skirted mentioning exchange rates directly, which was interesting as the reports had no problem writing about non-FX market prices (e.g., oil, stocks, gold, etc.). Most of these reports were daily updates that gave quick, uninspiring briefs of economic data releases prior to the update, but in such a broad sense that you would be better served by looking at an economic calendar, which would give you the same information in a quicker, more organized fashion. Like most of you, we aren't really sure what the point of FX brokers' daily updates were other than as some kind of marketing/sales gimmick to promote brand awareness because they certainly weren't informative, let alone actionable as they rarely talked about exchange rates! If one had to choose between bad and worse, banks' reports were the "better" products for information, yet still lacked corporate relevance.

After analyzing many different reports, we clearly understood your frustrations, and not just because you shared that with us. This culminated in the development of the weekly FX product, "In All Probability," that is more or less what you subscribe to today. There have been tweaks to the product since being released as we take your advice about what you need just as seriously as you take our advice on currency matters. Since inception, the product has excelled at meeting your needs despite some minor modifications (we expect it to evolve as your needs change), and we are certain it will continue to do what asked for: offer you a positive return on your FX by giving you the unvarnished, currency truth to empower you to make smart, informed decisions that help you manage you FX professionally with just a helping hand from us—once a week.

Your ask: timely, relevant, actionable information without bombarding your inbox, and a focus on currency & related market topics that are germane to a corporation's needs.

- Easily digestible information tailored to non-financial market professionals

- Clear, concise advice and commentary that actually tells you what to do and why. No double-speak.

- Price targets for both importers and exports for the week and month ahead for conservative and aggressive approaches

- Expected trading ranges with a corresponding probability to help you fine-tune price expectations

- Hedging recommendations inclusive of rational, price targets and hedge ratios

- Economic assessments and calendar to explain events that may impact near-term currency pricing to your benefit or disadvantage

Per your requests:

If you want us to help you unlock your Treasury's ROI to stop missing out on all the opportunities to improve margins and find cash flow, then check availability for scheduling your free Treasury Audit

Free Audit