In All Probability

FX Research & Advice You Asked For

With your feedback, we developed an FX product to fit the needs of owners, C-suite execs., cash managers, treasurers and accountants whom are responsible for managing their company's foreign exchange operations. Your needs varied depending on the scope of your operations, but based on your feedback we managed to define seven overarching needs that the majority described as their "ask." As such, we created a weekly report consisting of seven, distinct sections that will supplement and complement the existing currency operations of a do-it-yourself owner-operated company, and all the way up to the more advanced needs of a large corporation with sophisticated treasury functions.

At its heart, our product's goal is to be the next best thing to best-sourcing your Treasury FX needs to us as it has been meticulously crafted to "act" as your 'stand-in Treasurer' by offering you many perspectives, insight and recommendations on price action and market developments that come from our unique blend of combining wizened commentary, seasoned discretionary views and backed up by statistical analysis, not guesswork. We mainly focus on the USD/CAD exchange rate as over 90% of companies either solely or predominantly deal with this rate. Most of the trading volume in CAD pairs is done via the USD/CAD exchange rate, and the correlation between USD/CAD and other xxx/CAD exchange rates is usually very high, often greater than +0.80, which means that other CAD pairs directionally follow whatever the trend is in USD/CAD. For other currencies, we are available to perform analysis, research and offer recommendations via our Currency Concierge service.

The first section is cross-section of current Canadian dollar exchange rates at the time we run the report. Since the report is published anytime from Friday to Sunday (usually Friday, but this can depend on a number of factors), the current market rates will almost always reflect the week's closing prices for those currencies, the S&P 500, WTI crude oil (front month future price) and Gold. Thus, in-between weekly reports we have a number of client-only tools on our website to assist you with following and executing information provided in the report.

Current Market Rates

Client Foreign Exchange Tools

Weekly & Monthly Buy/Sell Prices: USD/CAD

We utilize a variety of statistical techniques coupled with technical analysis to designate specific "Value Areas" for the USD/CAD exchange rate. We provide three tiers of "Value Areas" to meet your needs based on your time frame and risk management approach to foreign exchange. The "Value Areas" are initially based on an exchange rate by using the probability density function to extract the probability that a given exchange rate has a value 'x'. The current spot rate (i.e., market rate) has a probability of 100% and the further the exchange rate moves away from the spot rate, the smaller the probability of a given exchange rate being realized over that time frame. If you need certainty in an exchange rate, the closer you place an order to the current spot rate, the higher the probability of the order being filled. We benchmark all the 'Coming Week's USD/CAD Value Areas' to the closing spot rate on the Friday our report gets published, and the performance can be seen by following the "Value Area Performance" link in the report header.

So, the feedback we received from you suggested that the majority has at least a week, most typically 1-3 months, before having to convert funds. As such, the value of the rates we provide is to get a 'better than market' rate. Accordingly, the most conservative rate and the one we would advise you to follow 9 out of 10 times is the 'Coming Week's USD/CAD Value Areas: "Good Value Areas",' which are targeted to have a 60% to 70% chance of filling. This provides you with rates that typically range 50 to 100 basis points above/below the current spot rate. "Solid Value Areas" are further down the probability curve in the 40% to 50% zone. These rates should be used if you have a couple of weeks or more before you need a higher probability fill, and the risk/reward tradeoff is that they target approximately 75 to 125 basis points +/- current spot rate.

For the very aggressive types, which we hope there are few of, the last tier "Extreme Value Areas" is of use when you have lots of time (i.e., at least 3 weeks) and should only be used in conjunction with the "Monthly Value Areas" as a guide to where the weekly "Extreme Value Areas" lie in conjunction with the probabilities of certain exchange rates on a larger (i.e., 30 day) time frame. As these are "extreme" rates, they are near the bottom of the probability curve and are selected with a probability around 10% to 20%.

The 'Rolling 30-day USD/CAD Value Areas' should be used only when you have 3-4 weeks remaining before you must transact. In fact, we would highly suggest that these "Value Areas" be used in a more indicative fashion for the current longer-term probability curve to give you an idea of what rates "may" trade over the next 30 days and at what probability. You can certainly use them like the aforementioned 'Coming Week's' value areas, but larger than normal shifts in volatility can unduly influence the rates and associated probabilities, making them much more difficult to use. If you decide to eschew the weekly targets in favour of the monthly targets, we advise sticking to the "Good Value" areas.

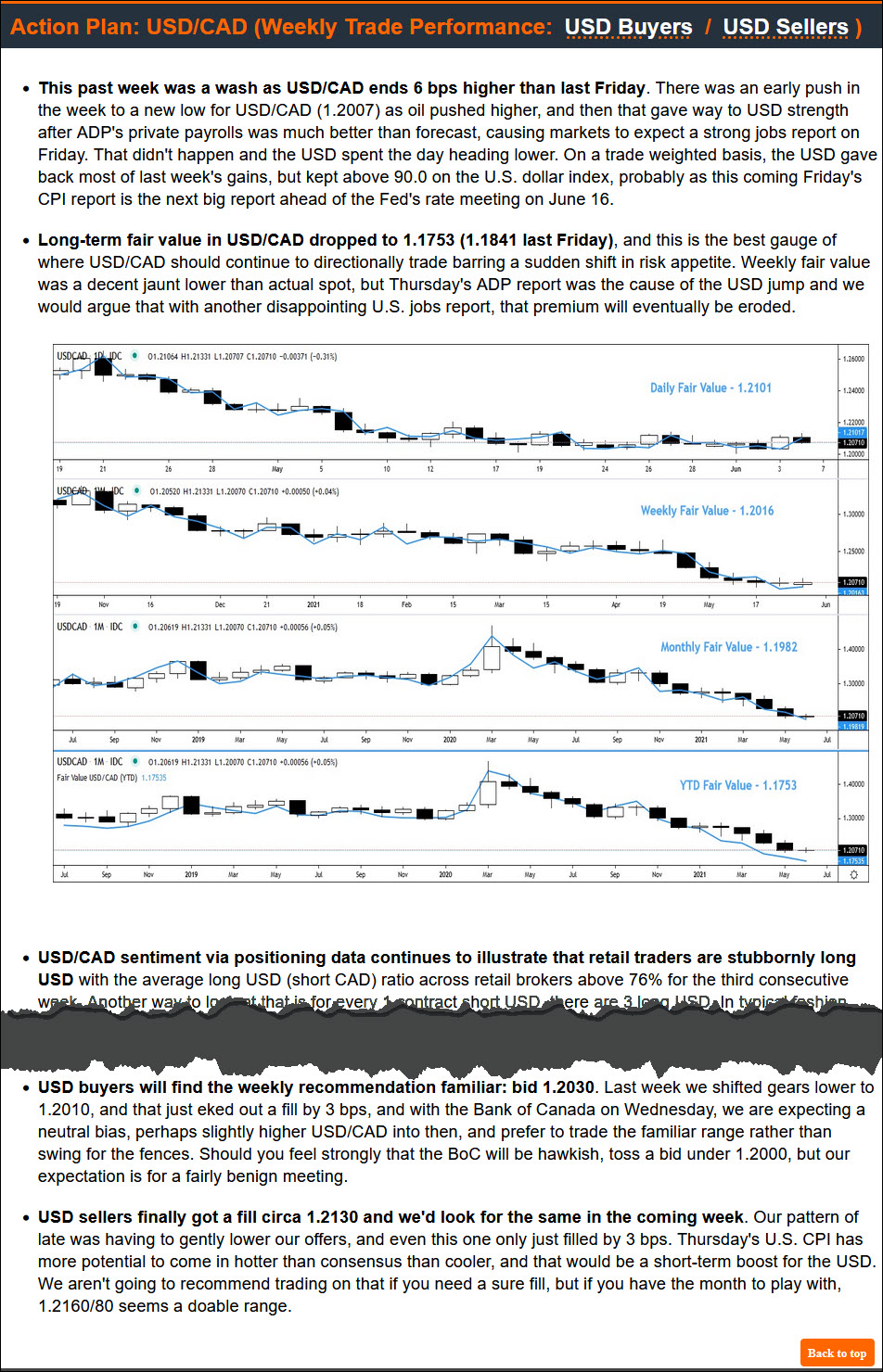

Action Plan: USD/CAD

For many of you, outside of the "Value Areas" above, this is probably the most important section as it contains predominately USD/CAD commentary, recommendations, insight and analysis. If you are looking to be extremely efficient with the amount of time you spend on currency related information, then both this and the section above will have you very well-informed on USD/CAD centric information in well under five minutes!

The general flow of the section begins with a quick recap of the past week's events that were instrumental in moving the USD/CAD. From there, we look at seasonality patterns in USD/CAD when applicable (i.e., usually near month-end), and then our proprietary 'Fair Value' models for USD/CAD based on different time frames (daily/weekly/monthly/year-to-date) to see how spot USD/CAD (i.e., the actual exchange rate) is trading based on where the model's factors suggest USD/CAD should be trading.

We take a weekly look at retail and professional trader positioning data to inform us, and you, of the current sentiment on the USD/CAD exchange rate. This is important as retail traders, when very long USD/CAD or short are excellent bellwethers of the current trend in USD/CAD. More exactly, whatever the sentiment from retail trader positioning is indicating (e.g., they are very bullish U.S. dollars & bearish loonies), we want to do the opposite of at extremes in their positioning. We look at the professional trader data to see where more knowledgeable and experienced groups are at, which can also help inform us of trend strength and directional shifts in the exchange rate.

This section culminates with two specific recommendations for USD buyers (importers) and sellers (exporters) for the coming week. On the probability scale, we give ourselves more latitude as these recommendations can have a mathematical probability ranging from around 20% to 70% of the rate being realized. We are typically more aggressive with our price targets when compared to the 'Value Areas' as we take into account other factors that could influence rates in the week ahead (e.g., upcoming news, economic events, cross-market dislocations, etc.). These recommendations are more subjective than the "Value Areas" and one could say they are our 'value added rates.' If you are looking for an exchange rate that doesn't stray too far from its target probability, we would recommend staying with the "Value Areas."

By the Numbers

You don't need to have an in depth understanding of option pricing, probability theory or statistics to take advantage of them because it is our job to do that for you! The data in these tables (i.e., implied exchange rates and probabilities) we use as the starting point for the "Value Areas" and "Action Plan" recommendations (before applying other information and techniques).

To derive the rates and probabilities in the 'By the Numbers' section, and without getting too technical, we take the pricing data from 1-week and 1-month FX option puts and calls on USD/CAD (this methodology can be done across a wide variety of exchange rate), and apply some statistical/probability equations to the data to find the implied range for the currency pair based on the time frame and probability we are targeting.

Our advice on how to use this data is to look at the implied ranges with the associated probability, and use these to help you intelligently narrow down exchange rates that are likely to aid you in achieving your desired rate over your given time frame.

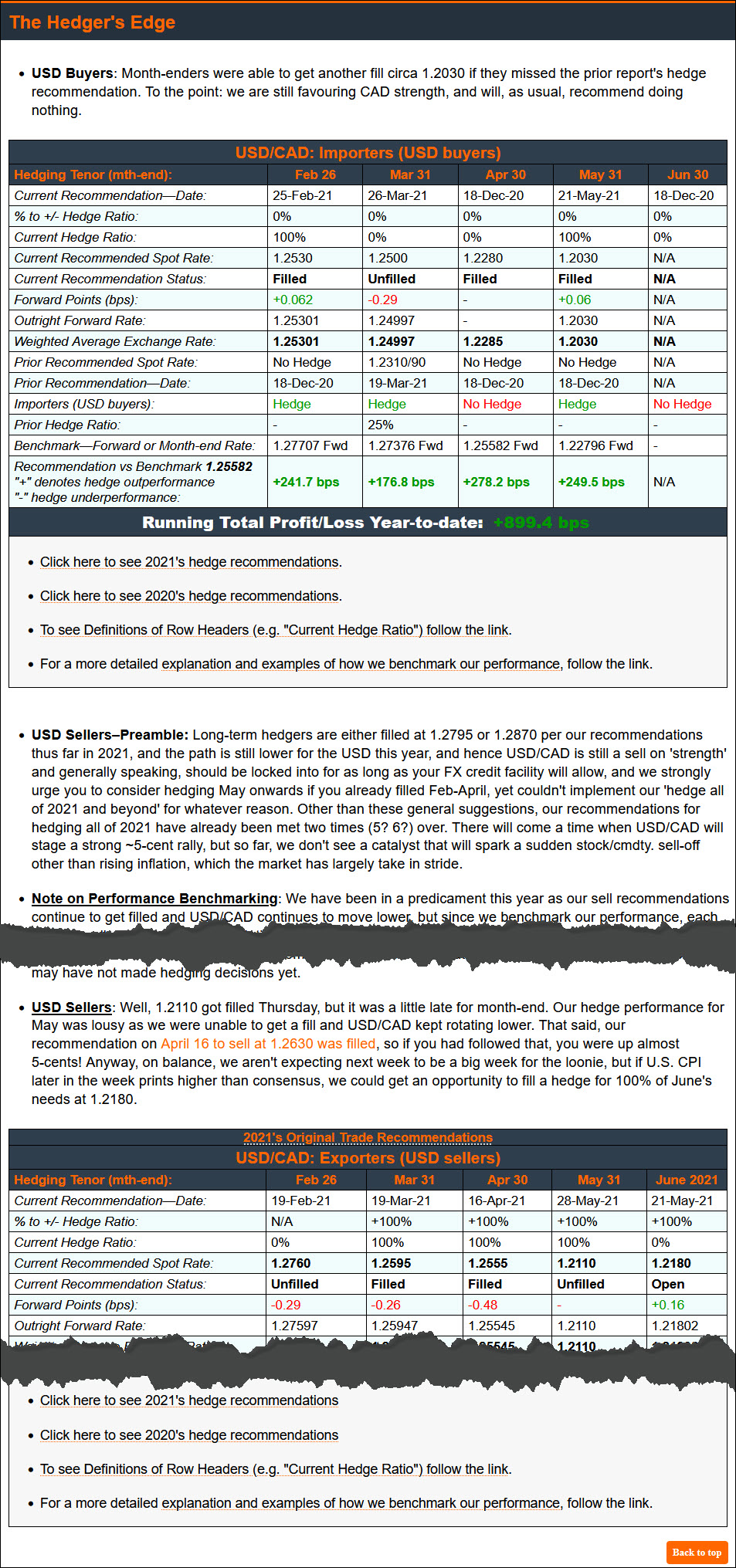

The Hedger's Edge

Many of you mentioned you are interested in hedging, learning more about hedging and some of you already hedge your FX risk, so this section is attuned to the needs of a corporation with the aforementioned interest in hedging, and for those of you already doing so; whether you are an importer or an exporter.

For those of you hedging, you mentioned that you typically hedge your FX risk out to 1-3 months, though there is a minority whom hedge out to 12 months and longer. The vast majority hedge by using forward contracts, placing a new hedge, typically, near the current month's end for the following month-end. Either a view that the rate would become either more favourable or less favourable were mentioned as the top deciding factors when assessing to hedge or not, in conjunction with a desire to protect margins. Trying to get the "best" rate (i.e., top/bottom picking) wasn't a prerequisite for those hedging.

To this end, we developed this section, 'The Hedger's Edge' to help you take advantage of market-timing by us looking at market factors that indicate whether hedging or not is the best method of lowering risk. As has been the theme throughout our FX product, 'In All Probability,' we first start off by looking at the implied ranges over a given time frame, the momentum in the exchange rate (positive or negative), the cost of carry/hedging (i.e., forward points which can be a benefit or a cost depending on if you're buying or selling) and value–which is judged by our fair value models– in order to determine whether it is the importers or exporters that would gain from hedging or not.

Since hedging is binary, in that you are either better off being 100% hedged or 0% hedged, our recommendations are also binary: Hedge or No Hedge. We are also firm believers that hedges should not be carried to maturity if they are at risk of being greatly underwater (out-the-money), which can be a significant drag on cash flow (e.g., working capital) due to your bank/broker requiring you to place more margin to secure the position (i.e., margin call) when the rate moves further out of your favour. Holding a losing position like this leads to compounding any financial loss if the hedged item doesn't gain in value at the same rate as the forward contract loses value. We therefore try to recommend rates and timings that minimize these negative outcomes, but there are times, as infrequent as they may be, where we advise closing hedges and taking a small loss now because our forecast is that it could be the lesser of two evils versus holding a losing hedge until maturity and locking in an even greater loss.

The hedging tables for importers and exporters are fairly simple to understand. In the case of a No Hedge recommendation, it means exactly that–do not hedge, as a number of factors generally aren't in your favour to support hedging. The counter-case is when we recommend Hedge because we view conditions as being favourable to locking in rates and removing some risk. We also provide you the amount (percentage) you should hedge, the exchange rate, the forward points it will cost and the weighted average exchange rate of the hedge recommendation for those cases where we advise hedging different percentages at different rates. We benchmark our performance against month-end spot and the forward rate at the end of the preceding month to show you how the hedge recommendations fared versus one or the other options that are most common in a passive FX management strategy.

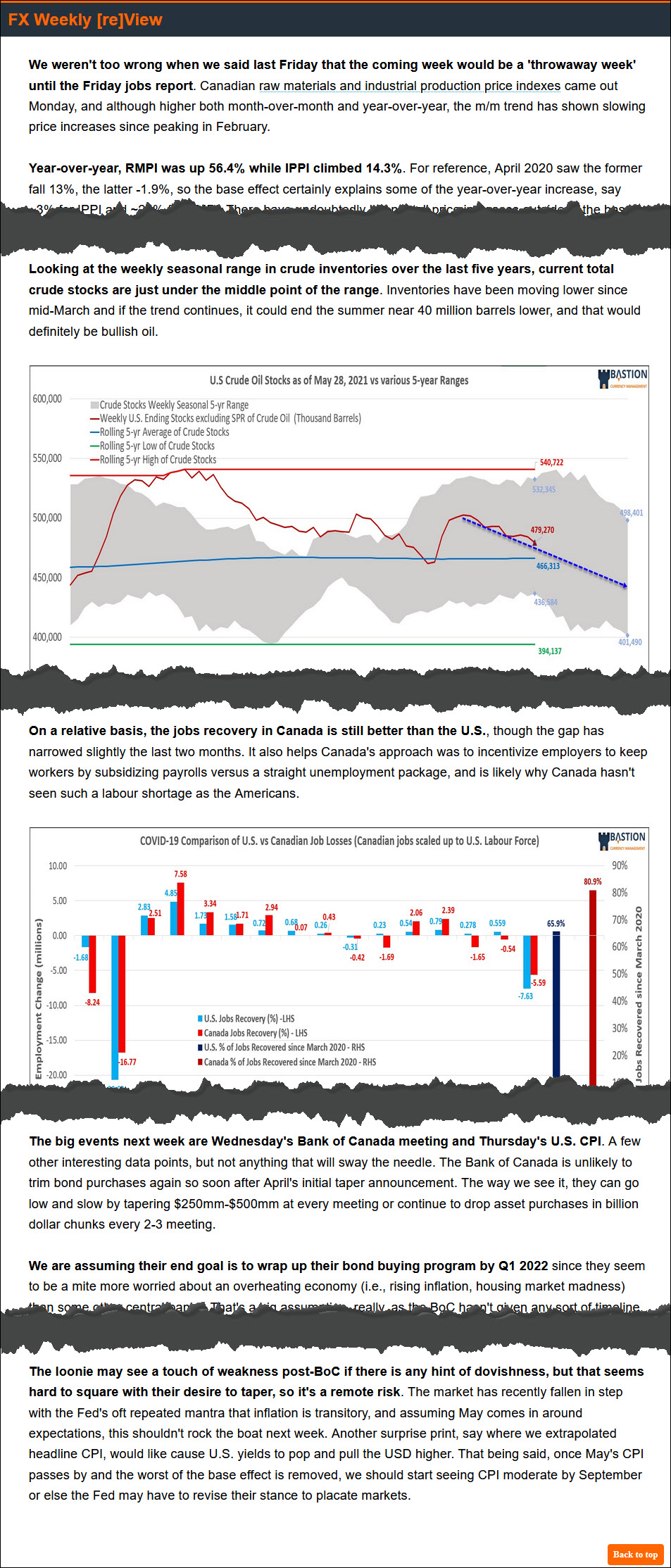

FX Weekly [re]View

Study the past if you would define the future. – Confucius

That is the FX Weekly [re]View in a nutshell. We must first take a look at the past week's events–political, economic or otherwise–to understand and interpret how these events are interwoven into the fabric of the market, which will continue to have effects into the following week and beyond. Hence, we start by reviewing the major items of interest in the past week and seek to present and analyze the information in a clear, approachable and often unique manner.

Having had the chance to review many bank, hedge fund and broker reports that analyze some of these topics, thanks in large part to your help furnishing us with these reports, we promise to do our best to NOT drone on about non-useful information or be too technical. We also try to present the information, when possible, visually with a different perspective that many ignore because, well, "if it ain't broke, don't fix it." We actually want our readers, you, to take away important points and gain new perspectives and be better armed to incorporate what you learn into your own business, perhaps by being able to make better sales forecasts as you gain awareness into how the economy is unfolding, for example.

Logically, we follow that up with the next part, the 'FX Weekly View.' In the second half of this section, we turn to the coming events of interest in the coming week and comment on what could be market moving or not. As we guide you through next week, we look to untangle this web of information to prognosticate the potential path for the exchange rate and what the means for you. This helps inform our recommendations in: Weekly & Monthly Buy/Sell Prices, Action Plan, The Hedger's Edge. So, although one might conclude that 'In All Probability' is compiled from top to bottom, we actually start the report off every week with this section–FX Weekly [re]View.

Do you need to read this section to make use of the rest of the report? No. The report is meant for you to navigate to what's useful and/or pertains to your situation and needs. That aside, this section is arguably the most important due to the scope and in-depth analysis of current topics that not only directly affect the exchange rate, but the economic climate of Canada and the U.S. Keeping up-to-date on such domineering topics can only serve your interests. Or, skip to the Action Plan and read the brief, weekly summary on USD/CAD if that works for you. You wanted an economic run-down and we think we more than delivered with the 'FX Weekly [re]View!'

There is no sugar coating financial/economic data can be rather dry, but it's as important to understand the macro-economic climate your business operates in as it is dry. Like Confucius, many centuries ago, said, "Study the past...define the future." Each and every business is different, but the commonality is that we all operate under the same, broad economic umbrella and it is imperative to stay on top of how our economies (U.S. and Canada) are evolving to better predict the impacts upon our own operations. This is precisely what the first part of the FX Weekly Review aims to do.

Economic Calendar

An economic calendar is your best friend even though you won't spend much more than a minute perusing it for upcoming, market moving events that are scheduled in the day/week ahead. The calendar shows items of 'High' impact in bold, so that you can quickly discern what events and releases could sharply affect the exchange rate in the coming week.

If you need to transact, you must be aware of these scheduled events as there is a potentially high chance that the exchange rate could quickly, and violently move in your favour (great!) or become very disadvantageous (not so great)!

This is one very important reason why we highlight such events in the latter portion of our 'FX weekly [re]View.' Suffice to say, although you should stay abreast of what is happening in the coming week, it's our job to keep you informed and explain how these events & releases could affect the exchange rate in the week to come. So, you don't need to drill too far down into the data as we've got you covered.

For those of you who feel the need you must stay on top of the economic, political and monetary goings on in the economy, we have a live economic calendar on our 'Client Foreign Exchange Tools' you will be permissioned to access.

If you want us to help you unlock your Treasury's ROI to stop missing out on all the opportunities to improve margins and find cash flow, then check availability for scheduling your free Treasury Audit

Free Audit